Discover & Trade Indices CFDs

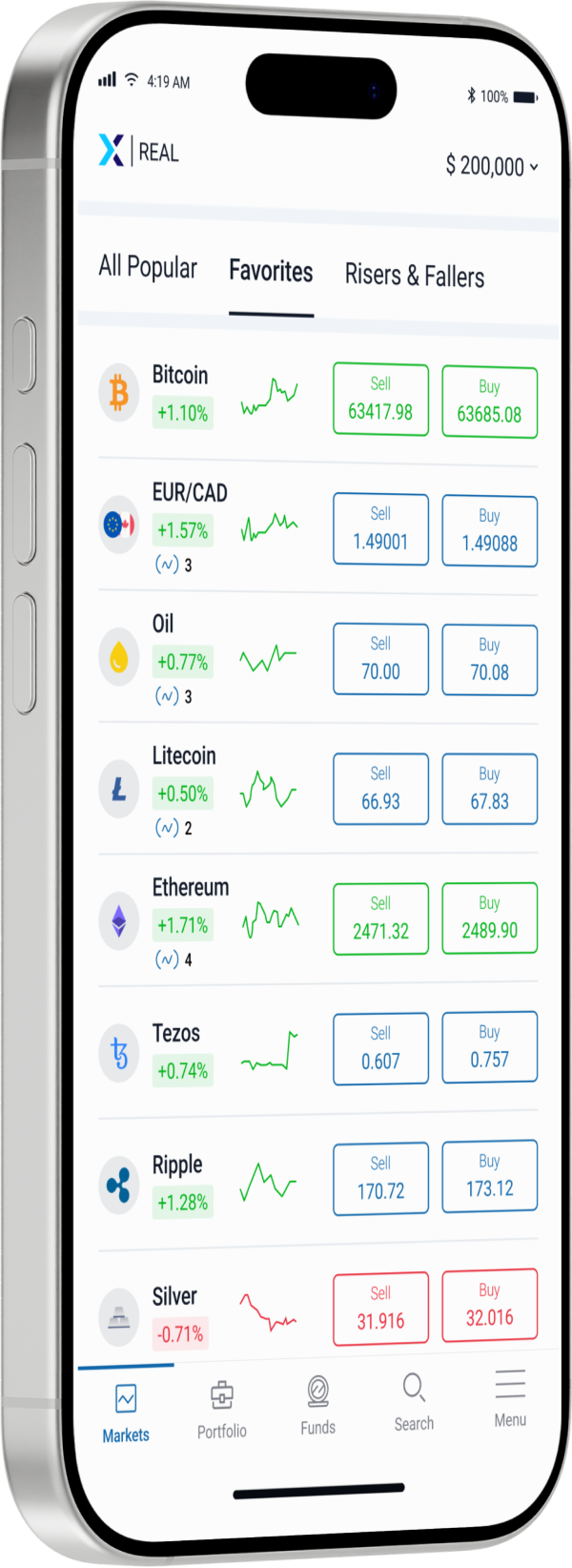

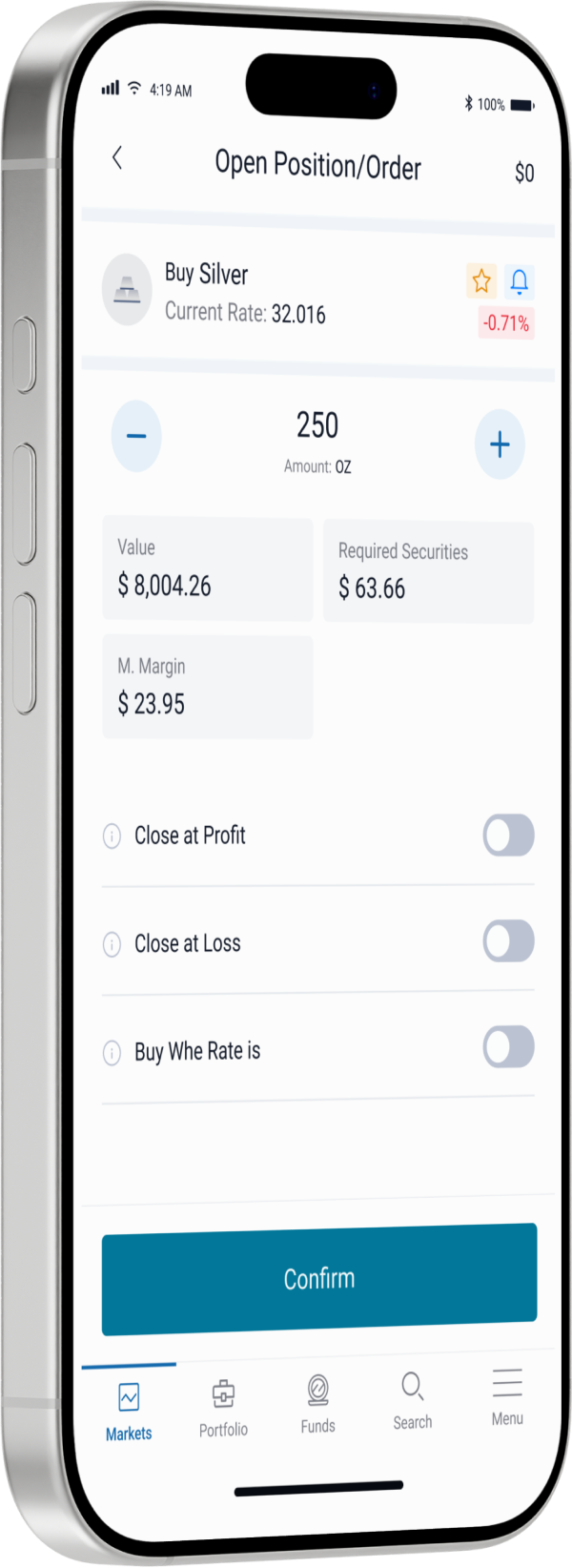

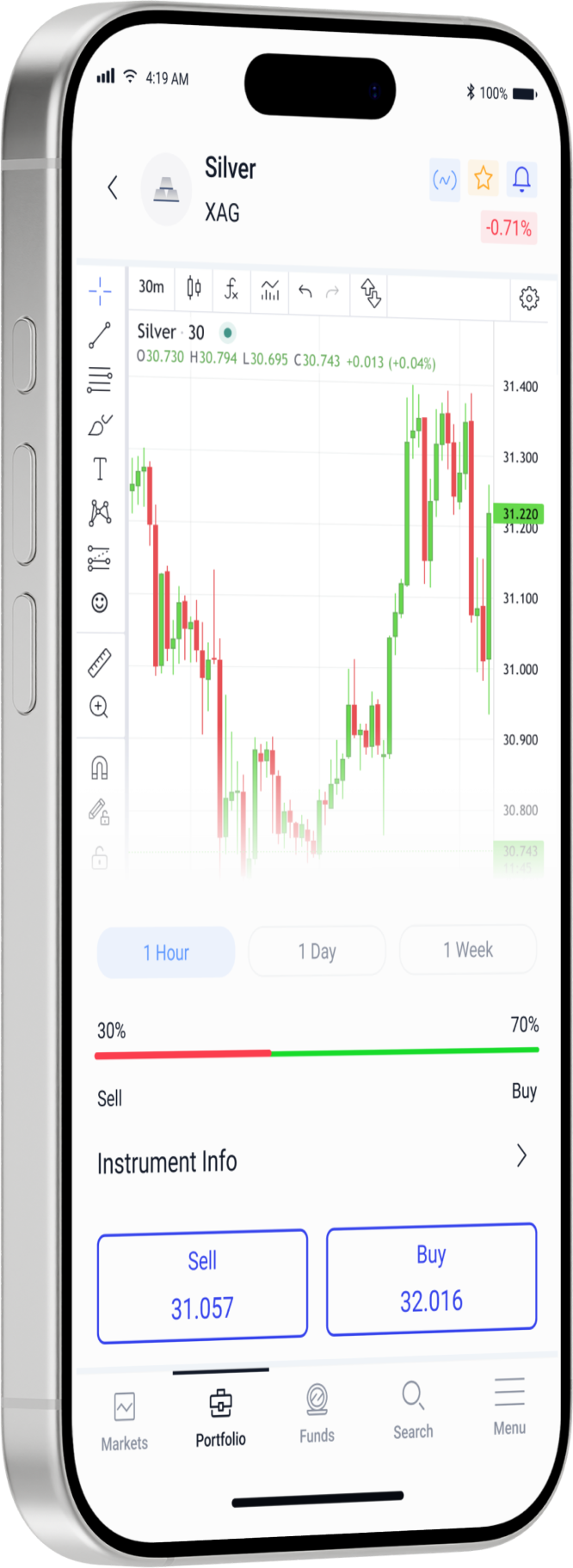

Trade popular Indices with a trusted broker for competitive spreads, fast execution, and low commissions.

Popular Indices

US-TECH 100

NDX

$

%

USA 30

YM

$

%

USA 500

ES

$

%

Russell 2000

RTY

$

%

US Dollar Index

DX

$

%

NASDAQ Composite

IXIC

$

%

US-TECH Cash

NASDAQ100

$

%

USA 30 Cash

US30

$

%

USA 500 Cash

SPX

$

%

AI Index

AI-Index

$

%

US-TECH 100

NDX

$

%

USA 30

YM

$

%

USA 500

ES

$

%

#IndicesTrading

About Indices CFDs

Stock index CFDs are financial instruments that mirror the value of index groups comprising publicly traded companies, such as the S&P 500, Dow Jones Industrial Average, and NASDAQ. CFD index trading offers a diverse range of investment opportunities, allowing you to trade both rising and falling markets.

Trading Education Library

A Comprehensive Guide to Professional Trading

Enhance your trading skills with comprehensive educational resources. Access tutorials, webinars, and courses tailored to your learning style. Master technical and fundamental analysis, risk management, and effective trading strategies. Achieve your trading objectives confidently.

#CompetitiveEdge

Why Invest with Us?