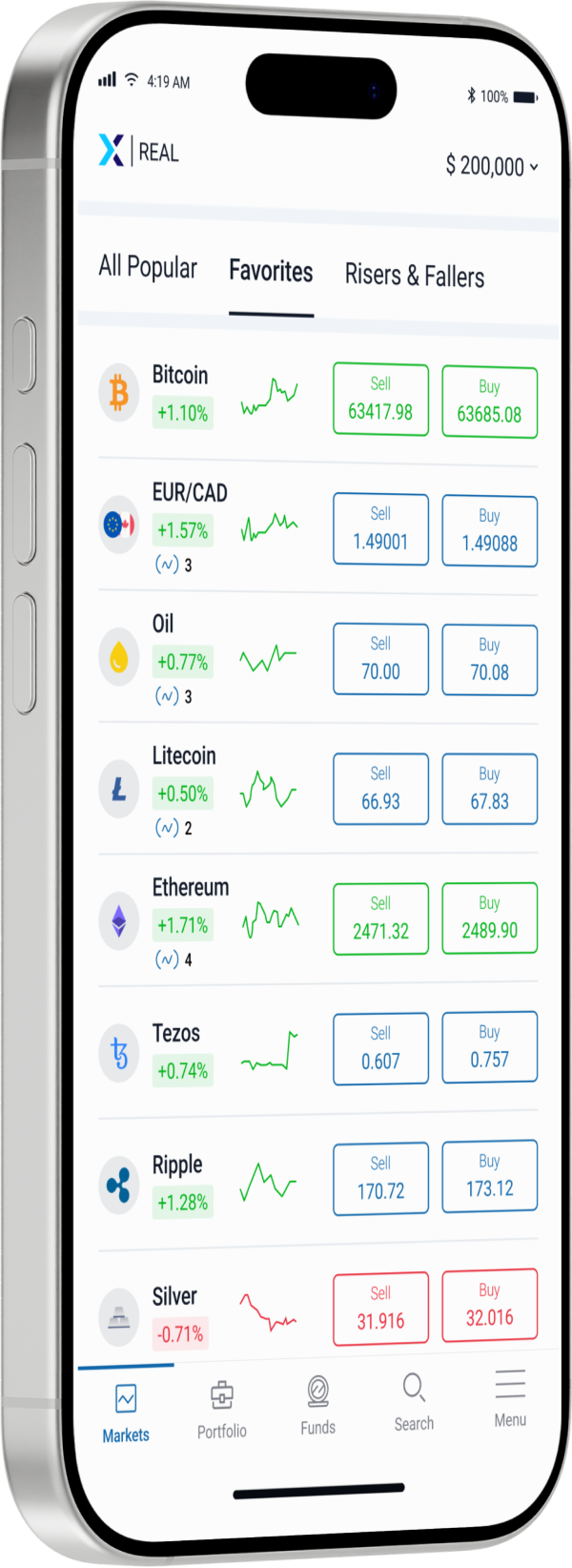

Discover & Trade Forex CFDs

Trade the world’s most popular FX pairs with a trusted global broker and benefit from competitive spreads, fast order execution and low commissions

Majors

Minors

Exotic

Popular currencies

EUR/USD

EURUSD

$

%

USD/JPY

USDJPY

$

%

GBP/USD

GBPUSD

$

%

USD/CHF

USDCHF

$

%

AUD/USD

AUDUSD

$

%

NZD/USD

NZDUSD

$

%

USD/CAD

USDCAD

$

%

EUR/JPY

EURJPY

$

%

EUR/GBP

EURGBP

$

%

EUR/CHF

EURCHF

$

%

EUR/USD

EURUSD

$

%

USD/JPY

USDJPY

$

%

GBP/USD

GBPUSD

$

%

#ForexTrading

About Forex CFDs

The foreign exchange market, commonly referred to as the FX market, is an online financial market that holds the title of being the largest and most traded globally. XTrade offers clients the opportunity to participate in forex trading through CFDs. By engaging in CFD FX trading, you can utilize your research and analysis to capitalize on exchange rate fluctuations, whether it's buying or selling currencies based on your price predictions.

Trading Education Library

A Comprehensive Guide to Professional Trading

Enhance your trading skills with comprehensive educational resources. Access tutorials, webinars, and courses tailored to your learning style. Master technical and fundamental analysis, risk management, and effective trading strategies. Achieve your trading objectives confidently.

#CompetitiveEdge

Why Invest with Us?