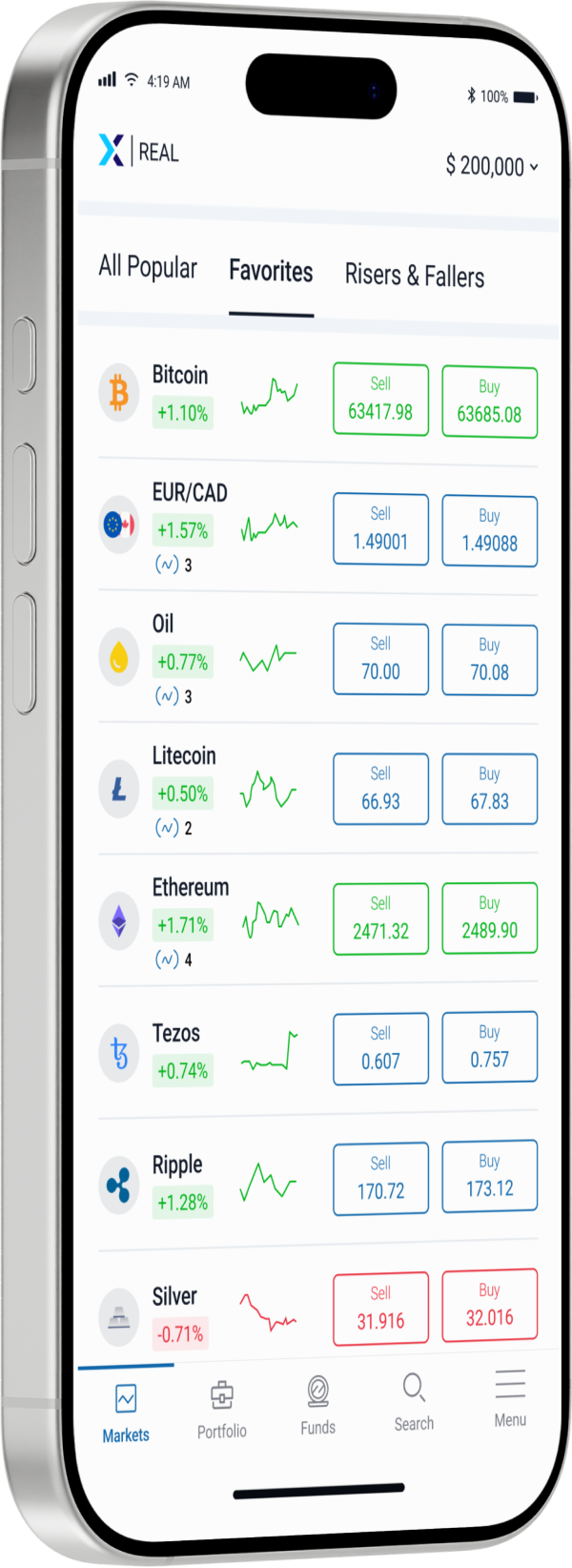

Discover & Trade ETF CFDS

Trade popular ETFs with a trusted broker for competitive spreads, fast execution, and low commissions.

Popular ETFS

USO-Oil Fund

USO

$

%

Direxion Daily Gold Miners

NUGT

$

%

Bitwise Crypto Industry Innovators

BITQ

$

%

Vanguard Value Index

VTV

$

%

ProShares UltraPro

TQQQ

$

%

Ultra VIX Short-Term Futures

UVXY

$

%

MSCI Brazil

EWZ

$

%

Direxion Small Cap Bear

TZA

$

%

UltraPro Short QQQ

SQQQ

$

%

UltraShort S&P500

SDS

$

%

USO-Oil Fund

USO

$

%

Direxion Daily Gold Miners

NUGT

$

%

Bitwise Crypto Industry Inno...

BITQ

$

%

#ETFTrading

About ETF CFDS

ETFs are traded investment funds that provide diversified exposure to specific indices, sectors, commodities, or asset classes. They allow investors to indirectly invest in a variety of assets, such as stocks, bonds, or commodities, through a single transaction, eliminating the need for individual security purchases. Trade ETFs with CFDs for price speculation without owning the assets. Enjoy the benefits of ETF liquidity, transparency, and cost-effectiveness compared to mutual funds.

Trading Education Library

A Comprehensive Guide to Professional Trading

Enhance your trading skills with comprehensive educational resources. Access tutorials, webinars, and courses tailored to your learning style. Master technical and fundamental analysis, risk management, and effective trading strategies. Achieve your trading objectives confidently.