Discover & Trade Bond CFDs

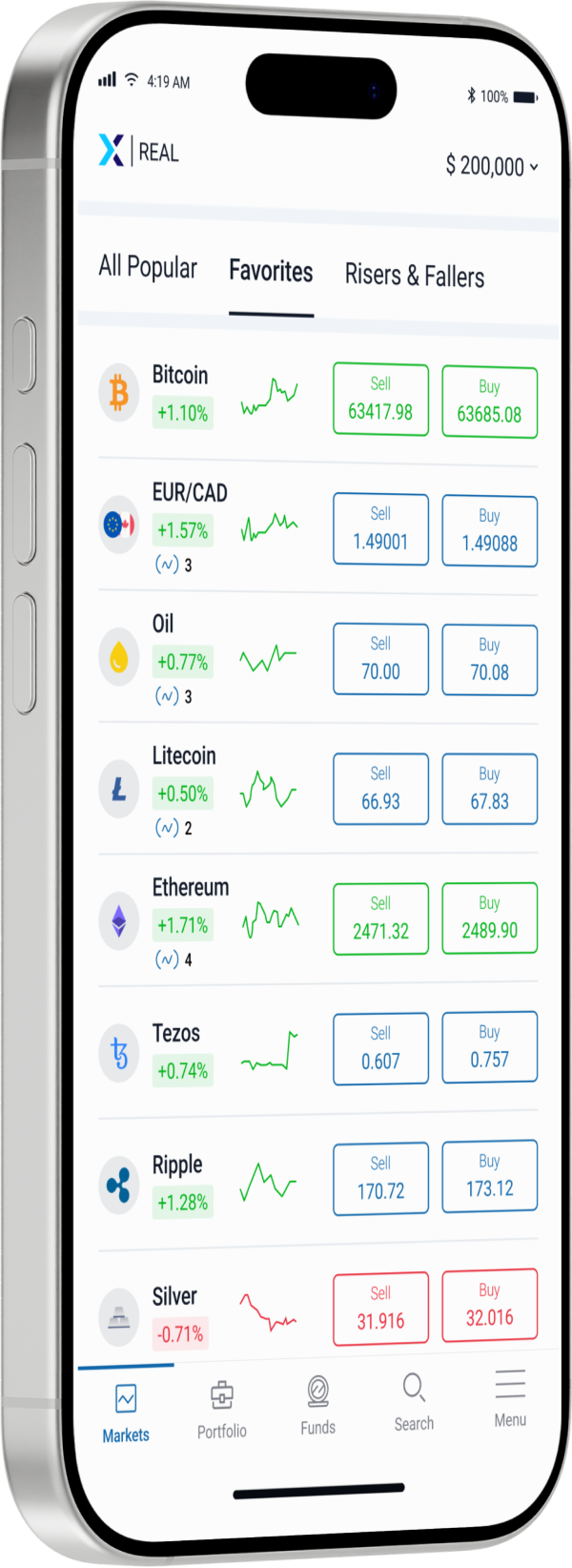

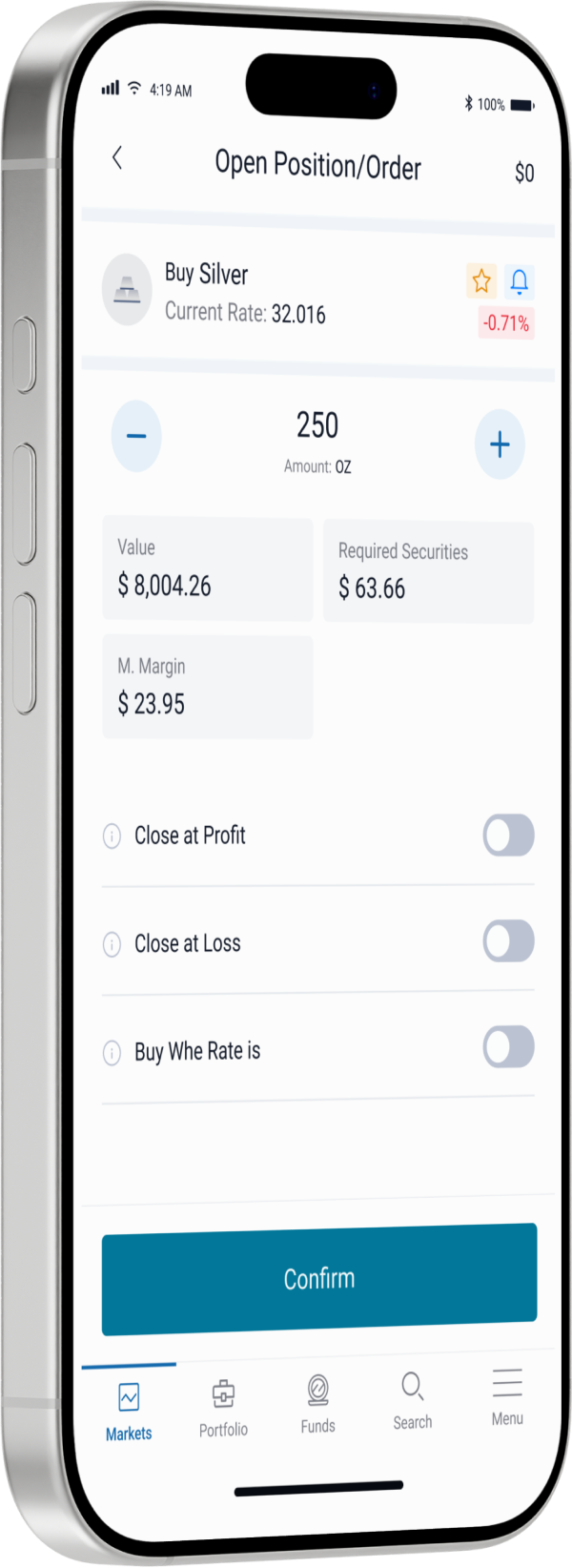

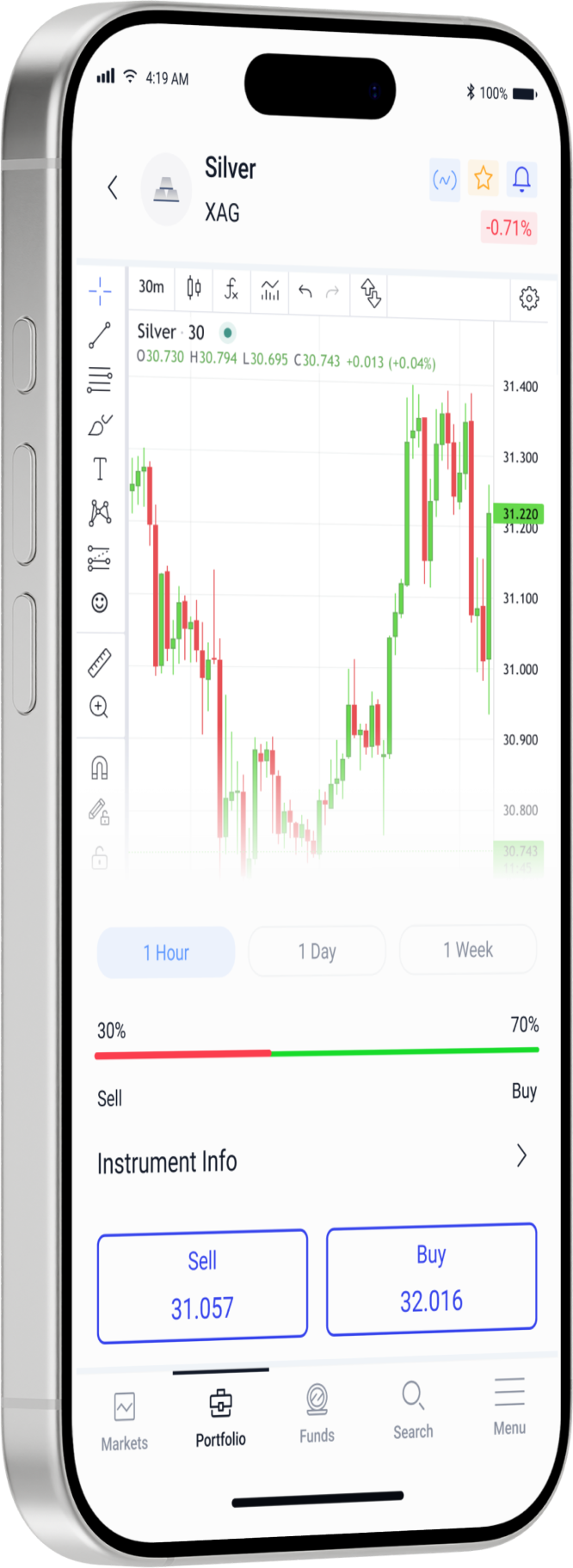

Trade popular bonds with a trusted global broker for competitive spreads, fast execution, and low commissions. Access bonds issued by governments, municipalities, and corporations worldwide, diversify your portfolio, and seize trading opportunities.

Popular Bonds

US 5Y T-Note

NI225

$

%

10Y Euro Bund

FGBL

$

%

Gilt Long Government

GLT

$

%

US 10Y T-Note

US10Y

$

%

US 30Y T-Note

US30Y

$

%

US 5Y T-Note

NI225

$

%

10Y Euro Bund

FGBL

$

%

Gilt Long Government

GLT

$

%

#BondTrading

About Bond CFDS

Bonds are fixed-income securities representing loans to governments, municipalities, or corporations, providing investors with interest payments and principal return. Trading bond CFDs allows price speculation without owning the bonds, benefiting from stable income, diversification, and capital preservation. Bond CFDs offer flexibility, liquidity, and leverage to access bond markets and optimize investment strategies.

Trading Education Library

A Comprehensive Guide to Professional Trading

Enhance your trading skills with comprehensive educational resources. Access tutorials, webinars, and courses tailored to your learning style. Master technical and fundamental analysis, risk management, and effective trading strategies. Achieve your trading objectives confidently.

#CompetitiveEdge

Why Invest with Us?