Open a new account

Account Login

The dramatic rise in the global forex market, has also been reflected in the growth of online trading in Australia via online forex brokers. While the overall foreign exchange turnover in Australia declined in the half year to April 2015 by 4%, the Royal Bank of Australia reports that non-bank online trading in Australia (FX and currency swaps and options) by locals grew 52%

Analysts cite several reasons for this anomalous growth.

The rise of CFD online trading in Australia has been gradual, propelled by both market and regulatory forces. While initially the governing authority ASIC (The Australian Securities and Investments Commission) pushed for exchange-traded standardized contracts, the efficiency of proprietary trading platforms proved to be irresistible. With increased recognition and approval, this channel has grown to prominence at the expense of other trading opportunities. ASIC has remained pro-active, publishing numerous informative and educating position papers to help small traders understand and master the intricacies of CFD instruments.

Australian authorities are relatively progressive in their oversight regime compared with their major trading partners. Traditional conservative cautiousness in Japan and provisions in the United States Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 limit domestic traders to significantly more severe leverage constraints.

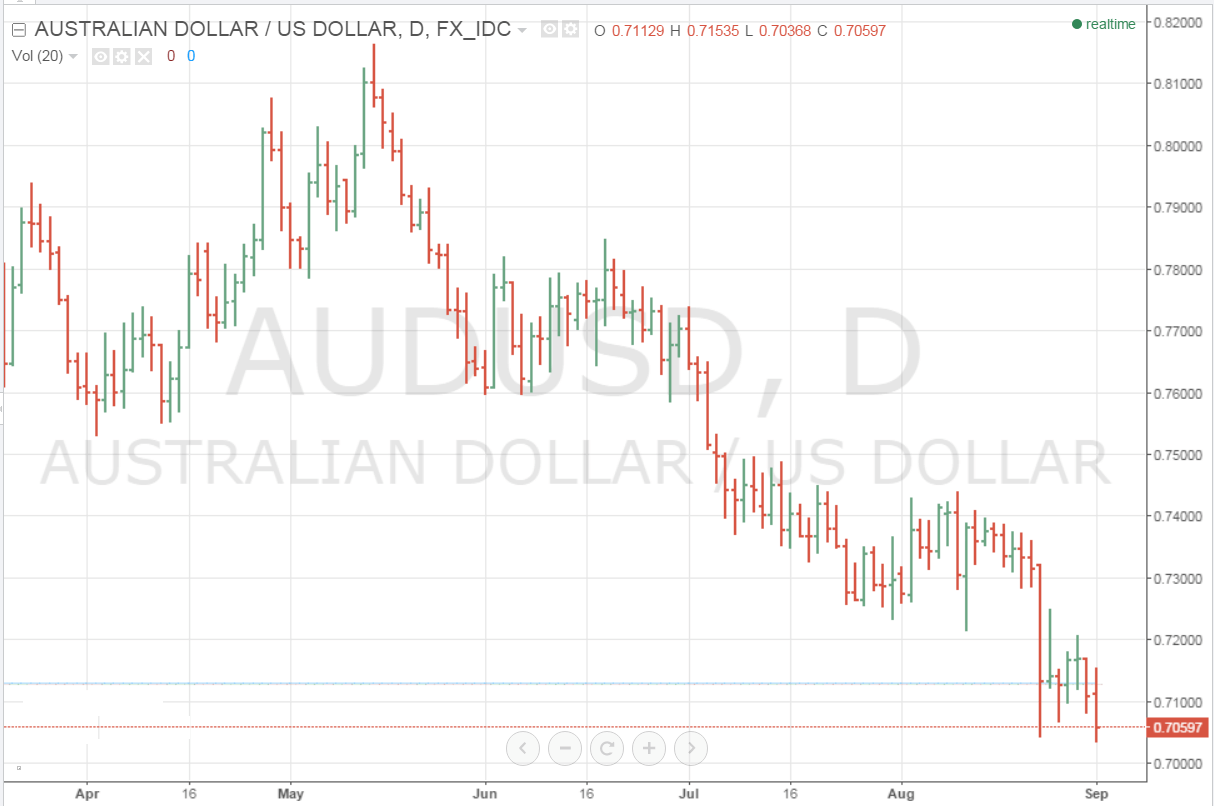

As alluded to above, the global economic environment underwent a significant upheaval in 2015, with a significant adverse effect on the Australian dollar. The reliance on commodities in general and the Chinese economy in particular became unprofitable, amidst a Chinese-recession-inspired global slowdown.

Gains and losses incurred through CFD trading activity for Australians can be subject to a variety of treatments, largely dependent on the relation of the principal activity of the trader: business, capital gains investment, or gambling.

Unfortunately, the considerations as to classification are myriad and subject to interpretation beyond the scope of this article. You are therefore advised to seek competent professional tax advice, before claiming your proceeds or losses in one category or another.

This website uses cookies to optimize your online experience. By continuing to access our website, you agree with our Privacy Policy and Cookies Policy . For more info about cookies, please click here.

or